Shoebox Receipts and Freelance Finances: 10 Bookkeeping Mistakes You Don’t Want to Make (and How to Fix Them)

Affiliate Disclaimer: This post may contain affiliate links. If you click through and make a purchase, WeI may earn a small commission—at no extra cost to you.

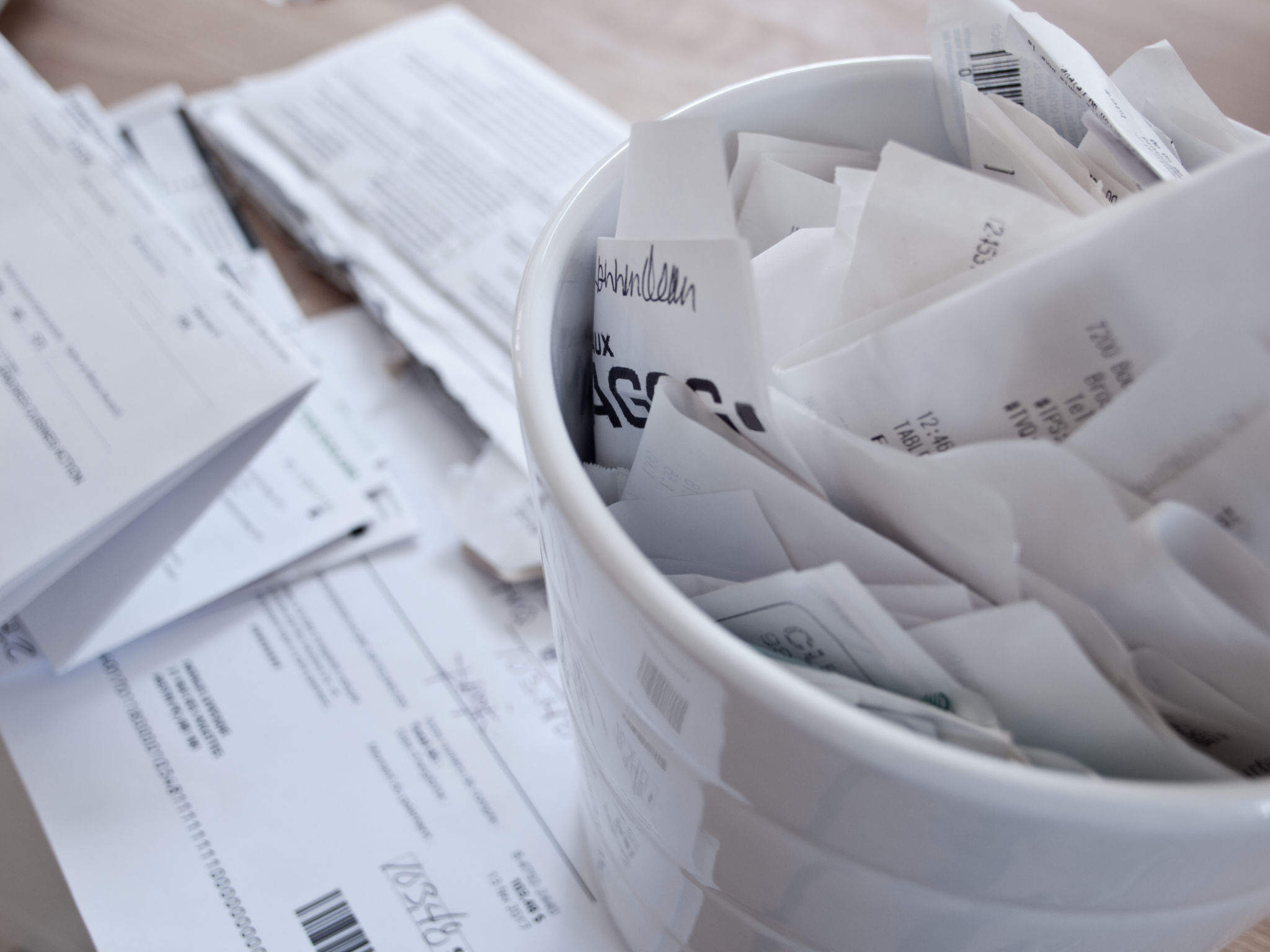

Imagine this: it’s tax season and you're knee-deep in a pile of crumpled, faded receipts stuffed into an old shoebox. You’re frantically trying to figure out which ones are business-related and which ones are from that 2 a.m. kitchen gadget binge. Sound familiar?

You’re not alone. Most freelancers would rather do anything other than bookkeeping. But here’s the truth: ignoring your finances is like sailing without a compass. You might stay afloat for a while, but eventually, you’re going to hit something.

We’ve rounded up the 10 most common bookkeeping mistakes—and how to fix them fast.

1. Mixing Business and Personal Finances

This one tops the list for a reason.

Using your personal bank account for business expenses might seem harmless when you're starting out, but it creates a confusing mess that’s difficult to untangle later.

Fix:

Open a separate business bank account and use it exclusively for business-related transactions. It’ll make tracking expenses way easier, look more professional, and keep you out of hot water come tax time.

2. Skipping the Small Stuff

That $5 latte while working at a café? That $12 Uber to meet a client? Those are legitimate business expenses.

Many freelancers only track large purchases and overlook the small ones—but those small expenses add up.

Fix:

Track everything. Use apps like Expensify, Dext, or QuickBooks Self-Employed to log receipts in real time. Don’t wait—you’ll forget.

3. Forgetting to Save for Taxes

Freelancers don’t get taxes withheld from paychecks. If you’re not setting aside tax money throughout the year, April can be a nightmare.

Fix:

Set aside 25–30% of your income for taxes and deposit it into a dedicated savings account. Make quarterly tax payments to spread out the burden—and avoid penalties.

4. Being Inconsistent with Your Books

Maybe you're on a roll for a few weeks, then fall off for months. Inconsistent bookkeeping can lead to missed deductions, untracked payments, and overall financial fog.

Fix:

Create a bookkeeping routine—10 minutes daily or 30 minutes weekly. Set calendar reminders or use habit trackers to stay consistent. Progress beats perfection.

5. Skipping Bank Reconciliation

Reconciling sounds complicated, but it’s just double-checking your records against your bank statements to catch errors or missing transactions.

Fix:

Reconcile your accounts monthly. Use accounting software to match transactions quickly. If something doesn’t line up, investigate right away—don’t let errors snowball.

6. Sloppy Invoicing

Late invoices or vague billing details delay payments and confuse clients.

Fix:

Use professional invoicing tools like FreshBooks, QuickBooks, or Wave. Include:

- A unique invoice number

- Clear payment terms

- Detailed descriptions

Track what’s sent, paid, and overdue like your income depends on it—because it does.

7. Disorganized Receipts

Receipts fade, get lost, or end up stuffed in random drawers. But during an audit, “I think I bought it for work” isn’t good enough.

Fix:

Digitize receipts immediately using your phone camera or an app. Organize them in cloud folders or accounting software. Treat receipts like gold—they can save you thousands in deductions.

8. Not Understanding Cash vs. Accrual Accounting

Cash accounting records income/expenses when money changes hands. Accrual accounting records them when they’re earned/incurred—regardless of when money is exchanged.

Fix:

Most freelancers use cash accounting—it’s simple and intuitive. But know the difference, choose one, and stick to it. If you're unsure, talk to a tax pro. This decision impacts your taxes more than you might think.

9. DIY-ing Everything (When You Shouldn’t)

You might be tempted to do it all yourself—but at some point, DIY bookkeeping can cost more than it saves.

Fix:

Run the math. If your billable rate is $75/hour and you spend 10 hours monthly on bookkeeping, that’s $750 of potential income lost. Hiring a bookkeeper for $30–50/hour could actually save you money and stress.

10. Not Using Your Books to Make Decisions

Your bookkeeping isn’t just about taxes—it’s a business growth tool.

Fix:

Review your financial reports monthly. Ask:

- Which services are most profitable?

- Are you spending too much in certain areas?

- Which clients bring in the most revenue?

Use the answers to guide pricing, marketing, and growth strategy.

Final Thoughts

Bookkeeping might not be the sexiest part of freelancing—but it’s one of the most essential. These 10 mistakes might seem small, but over time, they can drain your profits, time, and sanity.

The key isn’t perfection—it’s clarity and consistency. Start with one or two changes. Maybe that’s separating your accounts or committing to a weekly bookkeeping habit. Don’t try to overhaul everything at once.

The best time to get your books in order? The day you started freelancing. The second-best time? Right now.

Your future self will thank you.

Resources to Help You Get Started

Apps & Tools

- 💼 QuickBooks Self-Employed

- 📷 Expensify

- 🧾 Dext (formerly Receipt Bank)

- 💸 Wave Accounting

- 🧮 FreshBooks

Recommended Reads